Transaction Advisory Services for Beginners

The Buzz on Transaction Advisory Services

Table of ContentsThe 25-Second Trick For Transaction Advisory ServicesOur Transaction Advisory Services DiariesRumored Buzz on Transaction Advisory ServicesThe 8-Second Trick For Transaction Advisory ServicesNot known Facts About Transaction Advisory Services

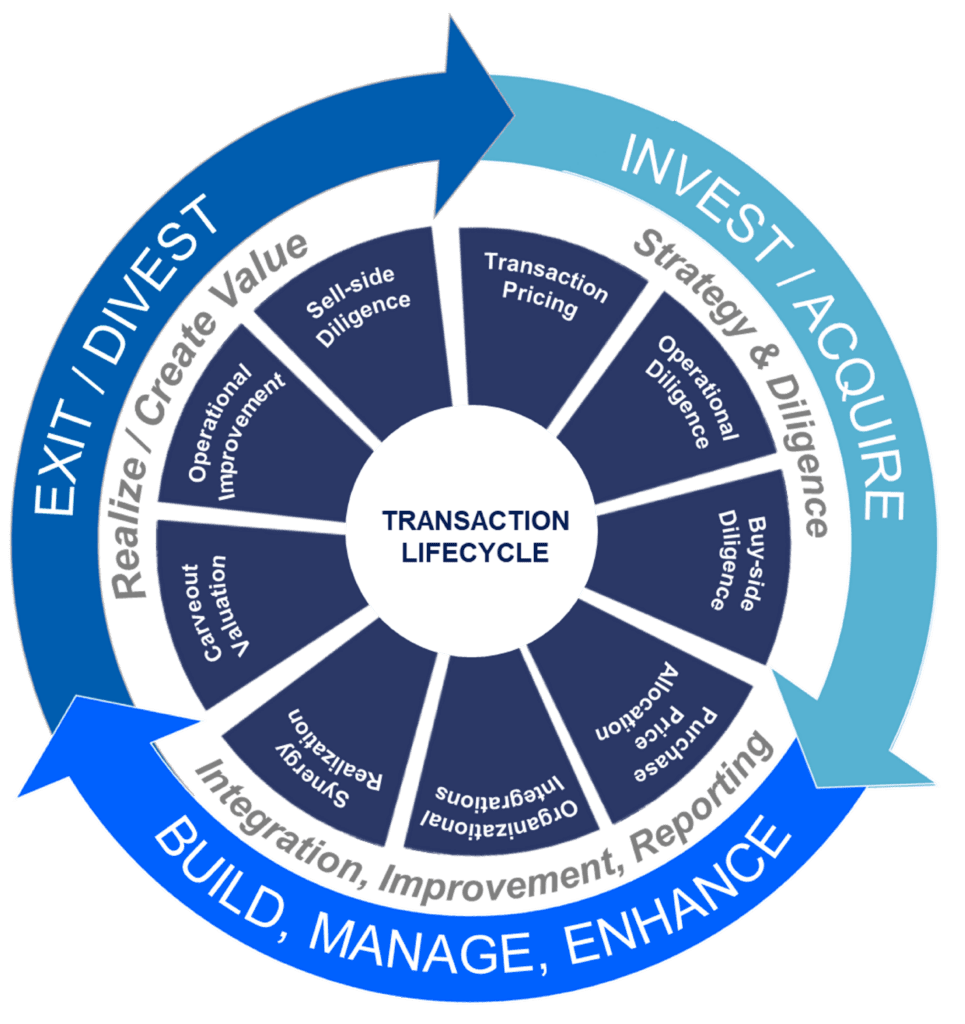

This action ensures business looks its best to potential purchasers. Obtaining the company's worth right is vital for a successful sale. Advisors utilize various techniques, like affordable cash circulation (DCF) evaluation, comparing to comparable companies, and current transactions, to find out the reasonable market price. This assists establish a fair cost and bargain efficiently with future customers.Transaction advisors step in to assist by obtaining all the needed details arranged, responding to concerns from customers, and preparing brows through to the service's place. This constructs count on with purchasers and keeps the sale moving along. Obtaining the very best terms is key. Purchase consultants use their competence to aid local business owner take care of challenging settlements, meet buyer expectations, and framework deals that match the owner's objectives.

Meeting legal policies is critical in any kind of organization sale. Purchase advisory solutions collaborate with lawful specialists to develop and examine contracts, contracts, and various other legal documents. This reduces risks and makes certain the sale adheres to the legislation. The role of deal consultants expands beyond the sale. They aid entrepreneur in preparing for their following steps, whether it's retired life, beginning a brand-new venture, or handling their newfound riches.

Deal advisors bring a riches of experience and expertise, making sure that every aspect of the sale is taken care of skillfully. Via calculated prep work, valuation, and settlement, TAS helps local business owner achieve the greatest feasible list price. By making certain legal and governing compliance and handling due diligence along with other deal group participants, transaction consultants decrease potential dangers and responsibilities.

Transaction Advisory Services Can Be Fun For Anyone

By comparison, Huge 4 TS groups: Work with (e.g., when a possible purchaser is conducting due diligence, or when a deal is shutting and the buyer requires to incorporate the company and re-value the seller's Balance Sheet). Are with charges that are not connected to the deal shutting efficiently. Earn fees per engagement someplace in the, which is much less than what financial investment financial institutions gain also on "little offers" (however the collection possibility is likewise much higher).

The meeting inquiries are really comparable to financial investment financial meeting inquiries, yet they'll concentrate extra on accounting and valuation and less on topics like LBO modeling. For instance, expect inquiries concerning what the Adjustment in Capital methods, EBIT vs. EBITDA vs. Web Income, and "accounting professional just" subjects like test equilibriums and exactly how to go through occasions making use of debits and credits instead than economic statement changes.

What Does Transaction Advisory Services Do?

Specialists in the TS/ FDD teams might additionally interview administration regarding every little thing over, and they'll write an in-depth record with their findings at the end of the procedure.

, and the basic form looks like this: The entry-level this website function, where you do a great deal of information and monetary analysis (2 years for a promotion from here). The next degree up; comparable job, yet you obtain the even more fascinating bits (3 years for a promotion).

Specifically, it's difficult to get promoted beyond the Manager level because few individuals leave the work at that phase, and you require to start showing evidence of your ability to generate profits to development. Let's start with the hours and way of life since those are less complicated to describe:. There are periodic late evenings and weekend job, yet nothing like the frantic nature of investment financial.

There are cost-of-living adjustments, so anticipate reduced look at here now payment if you're in a cheaper location outside significant economic centers. For all positions except Companion, the base pay consists of the mass of the complete payment; the year-end incentive may be a max of 30% of your base pay. Usually, the very best method to boost your earnings is to change to a various firm and discuss for a greater salary and benefit

Facts About Transaction Advisory Services Revealed

You might obtain right into corporate advancement, however financial investment financial obtains more tough at this stage because you'll be over-qualified for Analyst functions. Business financing is still a choice. At this phase, you should just remain and make a run for a Partner-level duty. If you wish to leave, maybe transfer to a client and perform their assessments and due diligence in-house.

The main problem is that because: You usually require to sign up with one more Huge 4 group, such as audit, and work there for a few years and afterwards move right into TS, job there for a few years and afterwards relocate right into IB. And there's still no assurance of winning this IB role because it depends on your region, clients, and the hiring market at the time.

Longer-term, there is additionally some risk of and because evaluating a business's historical economic details is not precisely brain surgery. Yes, humans will certainly always need to be involved, yet with advanced modern technology, reduced headcounts can possibly support customer interactions. That said, the Purchase Solutions group defeats audit in terms of pay, job, and leave chances.

If you liked this article, you could be interested in browse around these guys analysis.

How Transaction Advisory Services can Save You Time, Stress, and Money.

Create innovative economic frameworks that aid in determining the actual market price of a firm. Give advising job in relationship to organization evaluation to aid in negotiating and rates structures. Discuss one of the most ideal kind of the bargain and the sort of factor to consider to use (money, stock, earn out, and others).

Develop action strategies for threat and direct exposure that have been identified. Carry out integration preparation to determine the procedure, system, and business modifications that may be required after the deal. Make numerical price quotes of assimilation expenses and benefits to assess the financial reasoning of combination. Set standards for incorporating departments, modern technologies, and service processes.

Identify prospective decreases by minimizing DPO, DIO, and DSO. Analyze the prospective customer base, market verticals, and sales cycle. Consider the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence uses vital understandings right into the functioning of the company to be acquired concerning threat assessment and worth creation. Determine temporary modifications to financial resources, banks, and systems.